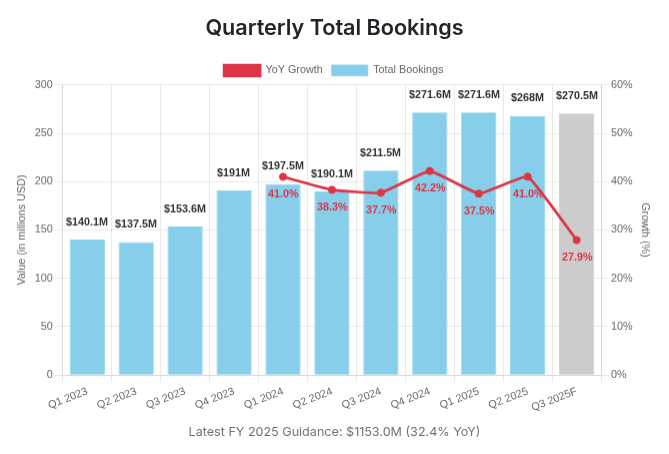

Duolingo delivers strong bookings growth but users engagement slows

In Q2 2025, Duolingo's bookings, a key leading indicator, showed robust growth of approximately 40%, showing the same sustained high growth from earlier quarters.

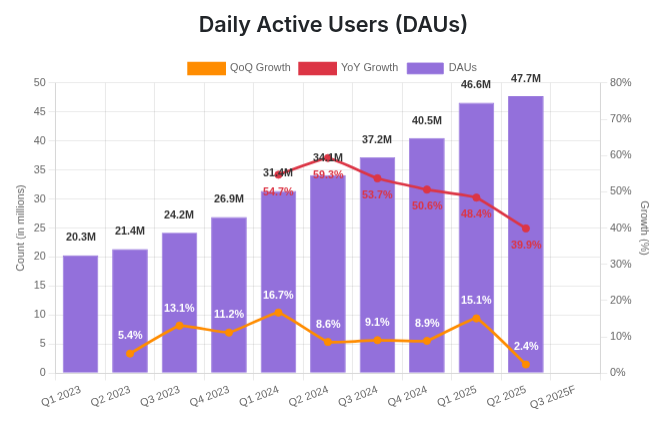

However, this was overshadowed by a sharp deceleration in other leading metrics, specifically the growth of Daily Active Users (DAUs) and Monthly Active Users (MAUs). This trend confirms a prior warning from analyst Andrew Boone of Citizens JPM regarding slowing user engagement and likely explains why the stock was sold into the earnings release.

In the subsequent conference call, management attributed the user growth issue to a tactical misstep in social media communication strategy after going "all-in" on Generative AI, which alienated some users and LinkedIn followers . In trying to repair the damage, they reportedly neglected the "edge marketing" that previously drove viral growth. While the CEO stated the problem is now solved, the company is not providing forward guidance for DAUs, only commenting that they do not expect "big changes." This lack of specific guidance raises concerns about whether the engagement slowdown will persist. The evolution of DAU and MAU metrics requires close monitoring.

Generative AI Transition Risk

There appears to be substance to user discontent regarding the GenAI implementation. While the percentage of subscribers on the "Max" (GenAI) tier has increased—from 5% two quarters ago to 8% in Q2 2025 - management conceded that its growth was below expectations. They postulate this may be because beginners find the AI-powered conversations too difficult. This appears to validate user complaints about the AI product's current quality. The company plans to address this by making MAX conversations bilingual, incorporating the user's native language.

Catalysts and Other Developments

Starting in 2026, the company expects enhanced profitability. This is due to regulatory changes, primarily the Digital Markets Act (DMA) in the European Union, which compel Apple to permit alternative payment systems. These rules allow Duolingo to direct users to its own website for enrollment, thereby circumventing the App Store's standard 15-30% commission on a portion of new subscriptions.

On other fronts, the company is not currently developing new subjects. The "Chess" feature has shown impressive growth, surpassing Math and Music despite being available only in English on the iPhone.

Final thoughts

I believe the future of Duolingo looks very promising, even if, every now and then, it might disappoint some users (or investors). The CEO is not interested in gimmicks that look good in the short term, but rather in long-term product quality and customer satisfaction. While many analysts are monitoring Reddit discussions for users' sentiment, it is critical to recognize that this cohort is not entirely representative of Duolingo's broader user base. Some expect this company to be rendered obsolete by direct AI translations on phones or other portable gadgets. I think Duolingo might be one of the companies successfully building an AI tutor.