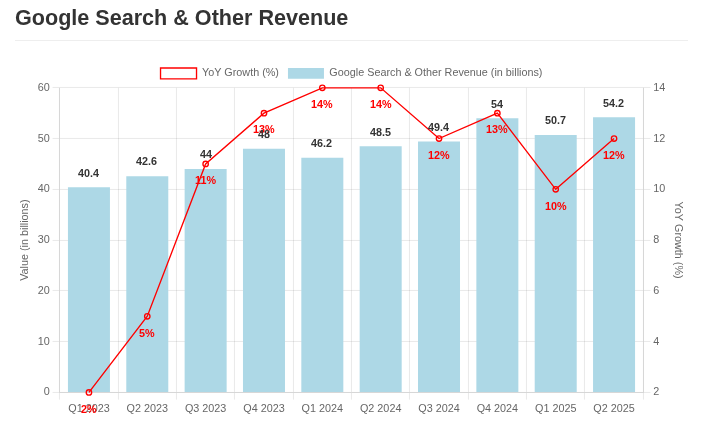

No dent in Google Search's revenue growth ... yet

Alphabet's Q2 2025 earnings provided a temporary reprieve from fears that AI chatbots are disrupting Google Search. While the market may have been placated, the results obscure a significant underlying threat to the company's core business.

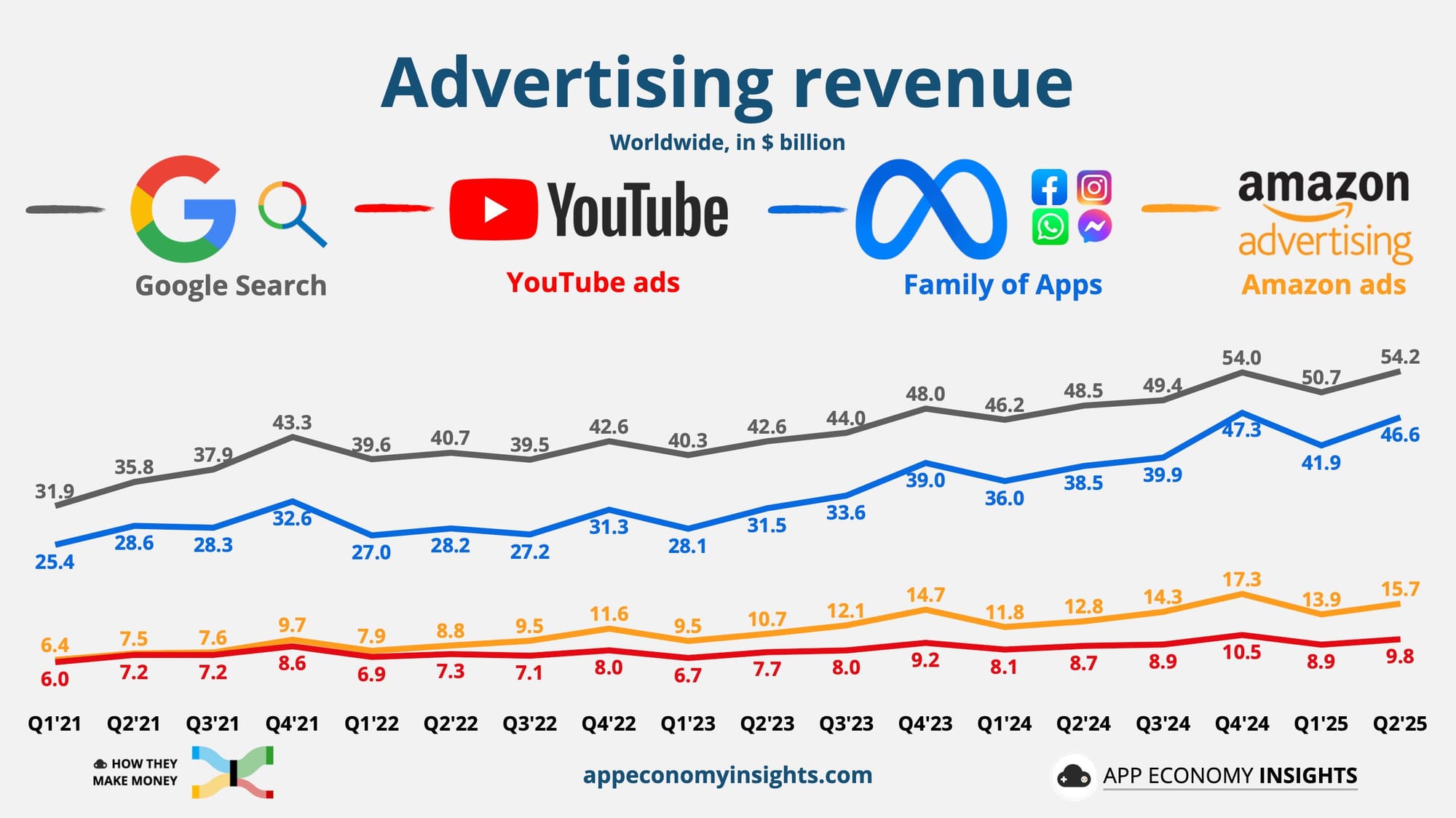

The primary bear thesis against Alphabet is that Large Language Models (LLMs) will erode the dominance of Google Search. The logic is straightforward: as users receive direct answers from chatbots, traditional query volume will fall, diminishing advertising inventory and revenue. While Alphabet's recent financials do not yet reflect this outcome - with Search ad revenue growing in line with peers like Meta - this should be viewed as a lagging indicator.

The resilience of Google's ad revenue can be attributed to a single, critical factor: for now, advertisers lack a viable, scaled alternative. This also means that, as soon as a viable alternative emerges, we could see a big and swift migration. ChatGPT already sends a significant volume of traffic to websites. As soon as they launch solid tools for advertisers, Google Search would be under immediate threat. Until then, Alphabet's management might be feeling a false sense of safety, thinking there is ample time to manage the transition to AI Overviews while retaining advertisers. Liz Reid, head of Google Search is out with an opinion denying any drop in Search traffic.

"... (our) data is in contrast to third-party reports that inaccurately suggest dramatic declines in aggregate traffic — often based on flawed methodologies, isolated examples, or traffic changes that occurred prior to the roll out of AI features in Search".

This statement creates a stark dichotomy. Either Alphabet's internal metrics genuinely show no user erosion, placing them at odds with widespread user testimony and third-party data, or the company is strategically emphasizing positive lagging indicators while downplaying negative leading ones.

The former seems improbable. The foundational user behavior is already shifting; the financial reckoning is merely delayed.